It’s no secret that the explosion of wealth in Russia has led to a greater increase of investment in international real estate. The recent instability caused by the Russian incursion into Crimea may be accelerating this trend. Many estate agents across Europe have been wringing their hands in anticipation of the flood that will surely come their way and Portugal is no exception. But, is hope enough?

Russian interest in real estate, both domestic and abroad, has increased steadily over the last decade. However, this has led to a lot of conjecture among European estate agents. The western mentality creates the assumption that the typical Russian buyer will be spending an extravagant amount of money in the sunniest possible destination, with a keen interest in new citizenship. Meravista’s research reveals that this is far from the reality.

Meravista has reviewed Russia-originated reports, research, websites and internet search almost exclusively to develop a report based on the Russian perspective of buying habits, rather than the West’s perception of why, what and where this nation is investing its money.

The investment buyer

Looking purely at foreign property purchase as a means of investment, the market analysts at Russia’s Indriksons.ru say that choice of country distils to one word: stability. Their recommendations for 2014 have the UK as their number one pick with the cities of London, Manchester and Birmingham as the preferred targets. They cite the UK’s continuing increase in both property values and number of sales as evidence of future gain. For similar reasons, Germany and France round out the top three. The views of analysts at Tranio.ru are not dissimilar.

Investment in arguably the highest priced property markets in Europe, indicate that this is the realm of the super wealthy and of high Russian officials; people who are looking for profit, often status, and can afford the high cost of such purchases. Indeed this appears to be the case as RealEstate.ru reports that in London and Paris, buyers from Russia account for 20% of all non-resident property purchases, with an average budget of 5.5 million dollars.

So what about the rest of Europe? Applying the same rationale of stability, Indricksons considers Bulgaria, Spain and Portugal as the worst picks currently for investment due to economic uncertainty. The Urban Land Institute concurs in regards to Portugal stating that “The country’s economic situation will clearly be key in 2014, with investors watching out to see if Portugal manages to keep to the terms of its bailout agreement.

However, Tranio.ru analysts acknowledge that the rock bottom prices of real estate in Spain and Portugal are actually a great opportunity to buy. They merely caution that it may take 3 to 5 years before prices rebound to allow a sale for profit. This appears to be a more realistic take on the majority of Russian property purchases.

The holiday home buyer

Putting aside the rarefied world of luxury and commercial investments, Russians are primarily looking for second homes.

Along with the recent spread of wealth in Russia, the nation’s ‘Life in two houses’ tradition of owning dachas (summer houses) in the countryside has reached the middle class. In fact RealEstate.ru claims that more than half of all Russian purchases are for a second home. The difference today is that Russians are now enjoying the opportunity to have their dacha in a foreign country.

Dachas in Russia are usually modest dwellings and the Russian buyers seem to want the same in a foreign property. Typical price ranges preferred by Russians, as reported in irn.ru, RealEstate.ru and Traino.ru, are between €100,000 and €200,000 regardless of country.

What is particularly interesting is that more than 95% of all purchases involve the Russian buyer retaining his or her existing home in Russia. This means that, although Russians are well aware of the Golden Visa programmes offered by Portugal and other European countries, residency and citizenship in the EU does not appear to be an objective for most Russian buyers.

That being said, the recent crisis between Ukraine and Russia has seen a large increase in UK property inquiries from wealthy Russian buyers seeking the possibility of relocation, to avoid the consequences of economic isolation by the West. The St. Petersburg Times reports that whenever there is political uncertainty in Russia, the wealthy there throw their money into central London property as an effective reserve currency. It appears ‘stability’ can work both ways. If security issues are now causing a play on UK property for the purpose of relocation, then it is fair to say that other countries across Europe may see similar increases.

When Meravista surveyed agents in the Algarve, asking whether they had dealt with Russian buyers in the past 15 months, it received a mixed response. The majority reported few or no enquiries from the Russian market. Some said that the Russian clients they had had, were here to take advantage of the Golden Visa programme.

Valdemar Santos of Valdana Imobiliáriain Albufeira says: “Everybody talks about the Russians, but I haven’t seen any yet.” On the other hand, João Carlos of JPP Properties in Vilamoura has sold a number of low to mid-priced homes to Russian clients. He comments: “They are not specifically looking for Golden Visas, like some nationalities, but they are serious buyers.”

Agents In the east of the region reported to have received a few enquiries from Russians, again looking for low to mid-priced property. Henrique Patterson of Patterson Properties in Tavira told us: “I did have one contact from Russia via Meravista. She was looking for something she can use now as a holiday home and as permanent resident in the future.”

Where they are putting their money

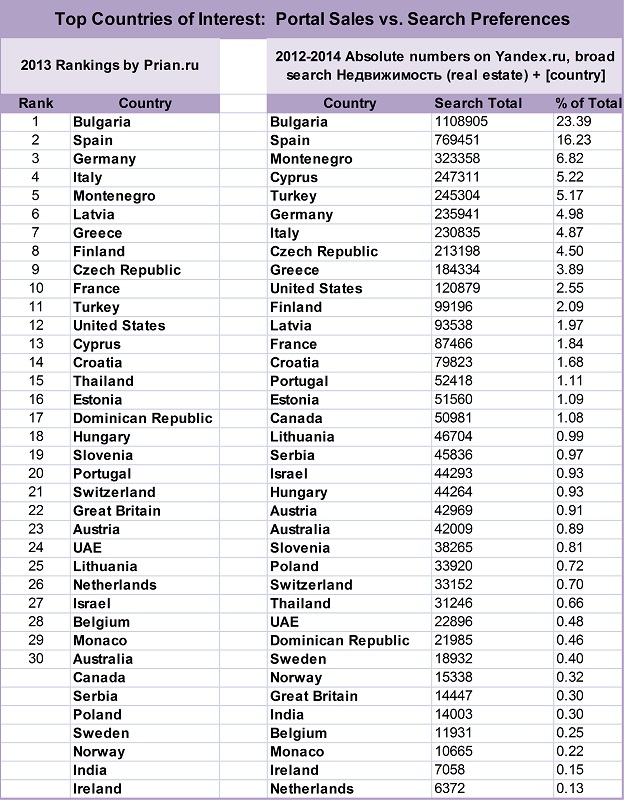

The leading property portal in Russia, Prian.ru, reported the top 30 countries Russian buyers went for in 2013. Bulgaria, Spain and Germany topped their list with Portugal ranking 20th overall and the UK 22nd. Clearly, the negative rating of Bulgaria and Spain by high-end investment analysts hasn’t influenced the vast majority of Russian purchasers.

In line with Prian.ru’s rankings, Portugal’s Agency for Foreign Investment and Commerce (AICEP) lists Russia as the 21st out of 55 listed countries making direct investment in Portugal. Even though there was an across-the-board decline in investment from all countries between the years 2012 and 2013, Russia accounted for the least decline of all, indicating a stronger degree of confidence from the Russian sector. Prian.ru’s numbers, however, are merely a reflection of the inventory of that portal, which is at the mercy of the agents and sellers that wish to use the service.

A more democratic approach is the measure of search volume for foreign property on Yandex.ru, Russia’s largest search engine with a 60% share of the search market in that country. Using a Cyrillic broad term search on Yandex.ru for real estate and country, Meravista finds the actual interests of Russians to be somewhat different, with Bulgaria and Spain still on top but Portugal ranking 15th overall and the UK 32nd.

It’s striking to see that even though Spain and Portugal share similar economic problems, culture and geographic location, the Russian public prefers Spain vastly more than Portugal. This is in spite of, as reported by Meravista, the reality that the cost of Portugal property is much lower than Spain’s.

So, why is Spain more attractive? The Urban Land Institute states plainly that “Portugal is…much less interesting than Spain.” Whether Portugal is less ‘interesting’ than Spain is a completely subjective observation. The real reason that Spain is targeted so much and Portugal so little, is the property listing saturation of Spain, Bulgaria and all other front runners in the property portals of Russia such as Prian.ru.

Russians buy what they see. And the plain truth is that the Russian property portals are dominated by the listings of estate agencies from countries who have taken the initiative to broadcast their properties there. Portugal is not one of those countries. The Moscow times reported that when budget is an issue the availability of low cost listings of Bulgaria, Montenegro, Croatia and Cyprus prove attractive to the Russian buyer. Portugal can easily compete with these countries pricewise, but without being available, the country’s listings will have no audience.

Another marketing tool is for an estate agency to create a second website in the Russian language and get the site indexed on Yandex. This is neither cheap nor easy, but it can payoff for the agency that is willing to invest in the effort. Meravista has found little evidence on Yandex that a native Portuguese estate agency has taken this step.

Meravista is currently listing over 14,000 properties for sale in the Algarve. Nearly 6,000 of these fall within the €100,000 to €200,000 price range. This alone indicates an opportunity for Portugal to target Russian buyers. But, for Portuguese estate agents, or any other country’s agents for that matter, to succeed in the Russian market with its new wealth, a demand must be created where none currently exists. Sitting back and hoping simply isn’t enough.

2014 Russian Property Investment in Europe

It’s no secret that the explosion of wealth in Russia has led to a greater increase of investment in international real estate. The recent instability caused by the Russian incursion into Crimea may be accelerating this trend. Many estate agents across Europe have been wringing their hands in anticipation of the flood that will surely come their way and Portugal is no exception. But, is hope enough?

(source www.google.com/trends, term “Недвижимость” (real estate))

Russian interest in real estate, both domestic and abroad, has increased steadily over the last decade. However, this has led to a lot of conjecture among European estate agents. The western mentality creates the assumption that the typical Russian buyer will be spending an extravagant amount of money in the sunniest possible destination, with a keen interest in new citizenship. Meravista’s research reveals that this is far from the reality.

Meravista has reviewed Russia-originated reports, research, websites and internet search almost exclusively to develop a report based on the Russian perspective of buying habits, rather than the West’s perception of why, what and where this nation is investing its money.

The investment buyer

Looking purely at foreign property purchase as a means of investment, the market analysts at Russia’s Indriksons.ru say that choice of country distils to one word: stability. Their recommendations for 2014 have the UK as their number one pick with the cities of London, Manchester and Birmingham as the preferred targets. They cite the UK’s continuing increase in both property values and number of sales as evidence of future gain. For similar reasons, Germany and France round out the top three. The views of analysts at Tranio.ru are not dissimilar.

Investment in arguably the highest priced property markets in Europe, indicate that this is the realm of the super wealthy and of high Russian officials; people who are looking for profit, often status, and can afford the high cost of such purchases. Indeed this appears to be the case as RealEstate.ru reports that in London and Paris, buyers from Russia account for 20% of all non-resident property purchases, with an average budget of 5.5 million dollars.

So what about the rest of Europe? Applying the same rationale of stability, Indricksons considers Bulgaria, Spain and Portugal as the worst picks currently for investment due to economic uncertainty. The Urban Land Institute concurs in regards to Portugal stating that “The country’s economic situation will clearly be key in 2014, with investors watching out to see if Portugal manages to keep to the terms of its bailout agreement.

However, Tranio.ru analysts acknowledge that the rock bottom prices of real estate in Spain and Portugal are actually a great opportunity to buy. They merely caution that it may take 3 to 5 years before prices rebound to allow a sale for profit. This appears to be a more realistic take on the majority of Russian property purchases.

The holiday home buyer

Putting aside the rarefied world of luxury and commercial investments, Russians are primarily looking for second homes.

Along with the recent spread of wealth in Russia, the nation’s ‘Life in two houses’ tradition of owning dachas (summer houses) in the countryside has reached the middle class. In fact RealEstate.ru claims that more than half of all Russian purchases are for a second home. The difference today is that Russians are now enjoying the opportunity to have their dacha in a foreign country.

Dachas in Russia are usually modest dwellings and the Russian buyers seem to want the same in a foreign property. Typical price ranges preferred by Russians, as reported in irn.ru, RealEstate.ru and Traino.ru, are between €100,000 and €200,000 regardless of country.

What is particularly interesting is that more than 95% of all purchases involve the Russian buyer retaining his or her existing home in Russia. This means that, although Russians are well aware of the Golden Visa programmes offered by Portugal and other European countries, residency and citizenship in the EU does not appear to be an objective for most Russian buyers.

That being said, the recent crisis between Ukraine and Russia has seen a large increase in UK property inquiries from wealthy Russian buyers seeking the possibility of relocation, to avoid the consequences of economic isolation by the West. The St. Petersburg Times reports that whenever there is political uncertainty in Russia, the wealthy there throw their money into central London property as an effective reserve currency. It appears ‘stability’ can work both ways. If security issues are now causing a play on UK property for the purpose of relocation, then it is fair to say that other countries across Europe may see similar increases.

When Meravista surveyed agents in the Algarve, asking whether they had dealt with Russian buyers in the past 15 months, it received a mixed response. The majority reported few or no enquiries from the Russian market. Some said that the Russian clients they had had, were here to take advantage of the Golden Visa programme.

Valdemar Santos of Valdana Imobiliáriain Albufeira says: “Everybody talks about the Russians, but I haven’t seen any yet.” On the other hand, João Carlos of JPP Properties in Vilamoura has sold a number of low to mid-priced homes to Russian clients. He comments: “They are not specifically looking for Golden Visas, like some nationalities, but they are serious buyers.”

Agents In the east of the region reported to have received a few enquiries from Russians, again looking for low to mid-priced property. Henrique Patterson of Patterson Properties in Tavira told us: “I did have one contact from Russia via Meravista. She was looking for something she can use now as a holiday home and as permanent resident in the future.”

Where they are putting their money

The leading property portal in Russia, Prian.ru, reported the top 30 countries Russian buyers went for in 2013. Bulgaria, Spain and Germany topped their list with Portugal ranking 20th overall and the UK 22nd. Clearly, the negative rating of Bulgaria and Spain by high-end investment analysts hasn’t influenced the vast majority of Russian purchasers.

In line with Prian.ru’s rankings, Portugal’s Agency for Foreign Investment and Commerce (AICEP) lists Russia as the 21st out of 55 listed countries making direct investment in Portugal. Even though there was an across-the-board decline in investment from all countries between the years 2012 and 2013, Russia accounted for the least decline of all, indicating a stronger degree of confidence from the Russian sector. Prian.ru’s numbers, however, are merely a reflection of the inventory of that portal, which is at the mercy of the agents and sellers that wish to use the service.

A more democratic approach is the measure of search volume for foreign property on Yandex.ru, Russia’s largest search engine with a 60% share of the search market in that country. Using a Cyrillic broad term search on Yandex.ru for real estate and country, Meravista finds the actual interests of Russians to be somewhat different, with Bulgaria and Spain still on top but Portugal ranking 15th overall and the UK 32nd.

It’s striking to see that even though Spain and Portugal share similar economic problems, culture and geographic location, the Russian public prefers Spain vastly more than Portugal. This is in spite of, as reported by Meravista, the reality that the cost of Portugal property is much lower than Spain’s.

So, why is Spain more attractive? The Urban Land Institute states plainly that “Portugal is…much less interesting than Spain.” Whether Portugal is less ‘interesting’ than Spain is a completely subjective observation. The real reason that Spain is targeted so much and Portugal so little, is the property listing saturation of Spain, Bulgaria and all other front runners in the property portals of Russia such as Prian.ru.

Russians buy what they see. And the plain truth is that the Russian property portals are dominated by the listings of estate agencies from countries who have taken the initiative to broadcast their properties there. Portugal is not one of those countries. The Moscow times reported that when budget is an issue the availability of low cost listings of Bulgaria, Montenegro, Croatia and Cyprus prove attractive to the Russian buyer. Portugal can easily compete with these countries pricewise, but without being available, the country’s listings will have no audience.

Another marketing tool is for an estate agency to create a second website in the Russian language and get the site indexed on Yandex. This is neither cheap nor easy, but it can payoff for the agency that is willing to invest in the effort. Meravista has found little evidence on Yandex that a native Portuguese estate agency has taken this step.

Meravista is currently listing over 14,000 properties for sale in the Algarve. Nearly 6,000 of these fall within the €100,000 to €200,000 price range. This alone indicates an opportunity for Portugal to target Russian buyers. But, for Portuguese estate agents, or any other country’s agents for that matter, to succeed in the Russian market with its new wealth, a demand must be created where none currently exists. Sitting back and hoping simply isn’t enough.